Content

Multi-member LLC has the same equity accounts as a partnership. Single member LLC has the same equity accounts as a sole proprietorship. We’ll explain some of the dire consequences of an improperly maintained chart of accounts, but first, let’s review what makes up a chart of accounts. Remember, your chart of accounts is like the inner workings of a car–the wires, pumps, engine–all these components direct the car where to take in energy and direct it out again. Sure, you can have a mediocre vehicle that “works,” but does it zing? Be sure to double check what’s already in place before adding a new account. This privacy notice provides an overview of our commitment to privacy and describes how we collect, protect, use and share personal information collected through this site.

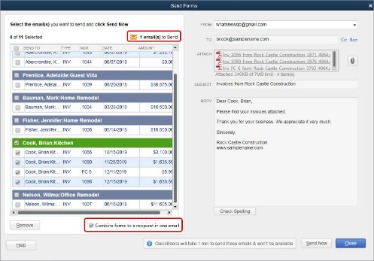

- The next screen will look like the one you saw when creating an account.

- The chart of accounts is the first step in creating your business’s accounting system, so it starts with organizing all your company’s financial information.

- Dancing Numbers template file does this automatically; you just need to download the Dancing Number Template file.

- Similarly, your inventory account must have Detail Type “Inventory” so that QuickBooks Online knows which account to increase when you purchase products.

To make this a subaccount, select the Subaccount of checkbox and then click on the drop down arrow to select the parent account. Often times a company will use subaccounts under a parent account to track different categories within the main account. If you are unable to see the option to terminate an employee on your list of active employees on the company payroll, this mostly implies that they have some history.

Banking

Punch list work might seem minor, but it has an improportionate impact on payment. In the construction business, everything comes down to the contract. And that’s unfortunate because most of the people who make…

However, https://intuit-payroll.org/ easy enough to add a chart of accounts line item in Stessa if needed. Either way, there’s no guesswork involved in setting up a chart of accounts, because Stessa has already done it for you. A chart of accounts offers a clear picture of the overall financial health of your business and gives insights into all of the company’s financial transactions. You can use that information to improve your business process in the future. Small businesses need a chart of accounts to organize their accounting for more simple and accurate financial reporting. Because your chart of accounts places all your financial data in one document, it makes it easy to track all your business information.

Basic and Practice of Nonprofit Accounting

You can create more than one Accounts Receivable account if needed. However, I do not recommend it because it adds the extra work of recording customer payments to the correct Accounts Receivable account.

Meet QuickBooks, the go-to platform for small business financial planning – New York Post

Meet QuickBooks, the go-to platform for small business financial planning.

Posted: Thu, 01 Dec 2022 08:00:00 GMT [source]

The credit card account type version of the Add New Account window will help in storing all the card details. Asset accounts basically contain everything that has some value, such as buildings, vehicles, land, inventory, valuables, etc. So, this type of Chart of Accounts helps in tracking how much the user paid for a property and also other factors like depreciation. Items that are in liquid forms, like cheques and other bank accounts, are also included in this Chart of Accounts. QuickBooks is, beyond any doubt, one of the best accounting software available in contemporary times. It is considered a boon for small and medium-sized businesses as this software helps in managing their finances and accounting tasks, thereby streamlining their business operations. QuickBooks has various features, and every year when Intuit launches a new version of the application, it comes with new and improved features.

How to Access a Chart of Accounts in QuickBooks Online

You don’t want to have one account with only one transaction posted to it. Thankfully, with QuickBooks Online and other small business accounting software programs, you don’t need to know how to set up a chart of accounts. QuickBooks Online makes it easy to set up a chart of accounts in just a few simple steps. When you first set up QuickBooks Online, your answers in the Startup Interview will help QuickBooks Online set up the chart of accounts for you, based on your industry and company. You can also select the drop-down list and choose a different tax line assignment, or click the “How do I choose the right tax line? If opened, close the help dialog box to continue.The tax line is necessary only if you or your accountant prepares the business’s tax return using software that integrates with QuickBooks. Click the expand button, which is the middle of three buttons, in the upper right corner of the chart of accounts window.

If the account has never been used in a transaction, the account will no longer count toward your maximum number of accounts. If the account has been used in a transaction, the history of the account will be retained, and the account will continue to count toward your maximum. First, click on the gear icon on the upper right-hand side of your QuickBooks dashboard, and then select Chart of accounts from the pop-up window, as shown below. Moreover, through the Accounts, users will come to know about the location where their data is getting reported.

Construction Industry Accounting

Get solutions to all of your accounting and bookkeeping problems with industry-leading experts. In this article, you read setting up VAT, set up VAT for trading abroad, and making tax digital with Sage … You can choose to provide details in the Description box and an actual amount in the Balance field. To specify the sort of account you want to add, choose the Detail Type. Direct expenses are those expenses directly related to producing income from a job, project or product. Unrestricted net assets are donations in which the donor doesn’t specify where or how the nonprofit uses the donation.

And with some mapping to an Intuit Setup A Chart Of Accounts In Quickbooks software program, the client’s trial balance amounts can be exported to the company’s tax return by the tax preparer with another click of the mouse. Adding too many accounts to your accounting system can make your chart of accounts unnecessarily lengthy and make your financial reports confusing.

Company Address

The above tax advice was written to support the promotion or marketing of the accounting practice of the publisher and any transaction described herein. Let’s assume an investor purchases a single-family rental home for $125,000, which includes a land value of $15,000. The investor makes a 25% down payment and finances the balance due with a new first loan of $93,750. You can download this Chart of Accounts List with Industries and business types in Excel and import the portion that suits your business to QuickBooks.